- #FILE FOR 2016 TAX EXTENSION ONLINE HOW TO#

- #FILE FOR 2016 TAX EXTENSION ONLINE PDF#

- #FILE FOR 2016 TAX EXTENSION ONLINE DOWNLOAD#

#FILE FOR 2016 TAX EXTENSION ONLINE HOW TO#

Here’s how to use Prior Tax for your missed 2016 tax deadline: This process is typically completed within one business day. Your refund will automatically calculate as you enter your tax information into your account. By choosing Prior Tax to file your prior year returns, avoid the hassle of appointment times or tedious calculations.

#FILE FOR 2016 TAX EXTENSION ONLINE DOWNLOAD#

You can either download the IRS forms online and manually calculate your refund or let us help you. You can either request this income transcript online or have it mailed to you.Ĭlick here to request your income transcript. If you still cannot obtain a copy, request an IRS transcript for a detailed summary of all income for the tax year. If you’ve lost your income statement or do not have access to them, contact your employer to provide you with a copy. You will need a copy of your income statements, (W-2, 1099-MISC, 1099-G, etc.) insurance statements, (1095 Forms) and documentation of the expenses you are reporting. What do I need?įirst, gather all of your tax documents. All you need to do is print, sign then mail your return to the addresses that we provide to you.

#FILE FOR 2016 TAX EXTENSION ONLINE PDF#

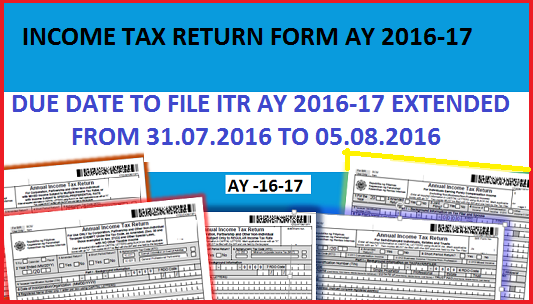

Fortunately, Prior Tax provides you with a downloadable PDF of your tax return. ALL taxpayers must paper-file their prior-year 2016 tax return. Regardless, for prior year returns, the IRS requires taxpayers to physically sign their returns. Since the e-file deadline passed on October 16th, 2017, you cannot e-file your return. Read on to find out how to file your 2016 prior-year return.

If you want to find out if you have a refund coming your way, utilize our 2016 tax calculator. That being said, start raiding your rooms for all the receipts you need to finish your taxes. Luckily, you can still file your 2016 tax return if you’re one of many taxpayers that are rushing to stay on top of a missed 2016 tax deadline.

Contact us to get a paper form if you can't file online.With tax seasons coming and going, you probably have some catching up to do. Only individuals, partnerships and fiduciaries filing a calendar year return can request extensions online.

Get more information if you need to apply for an extension of time to file your return. Income tax applications for filing extensions Laws of New York State (New York State Legislature).Laws of New York State (New York State Senate).

0 kommentar(er)

0 kommentar(er)